I am in my third week since leaving Auckland for my microfinance internship here in Mumbai, India!

Similar to Auckland, Mumbai is the country’s financial hub and also a city of migrants. As the country’s commercial capital, Mumbai appeals much to anyone searching for work and better career prospects. Indians from every part of the country move to the city every day in search of a better life. Hence, Mumbai is often called the ‘City of Dreams’ by locals

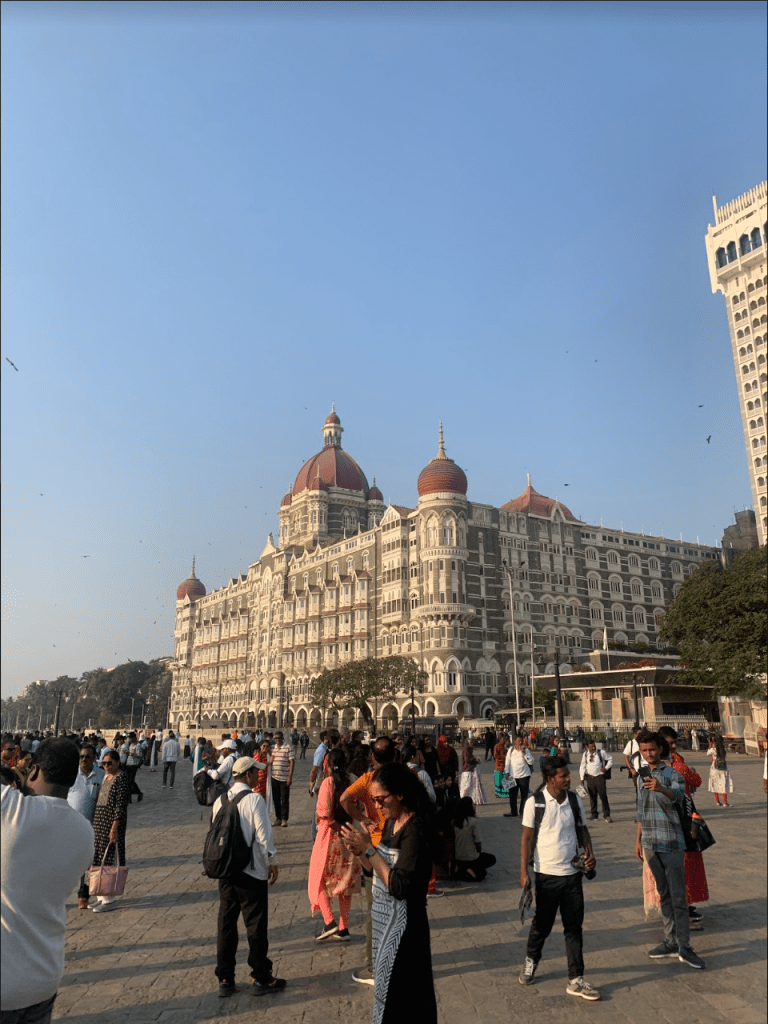

Pictures: 1. Taj Hotel 2. Queen’s Necklace – Marine Drive 3. Gateway of India

My internship is in the microfinance sector, which is gaining popularity in developing countries, particularly in Southeast Asia. I work at New Opportunity (NOCPL), a business correspondent that connects rural women with commercial banks and provides them with financial services. We help women in rural areas access micro-loans to kickstart or sustain their businesses and provide them with financial literacy courses and other life skill classes.

Microfinance – a bit of a background

The microfinance sector provides financial services to low-income clients, including consumers and the self-employed, who traditionally lack access to banking services. This niche type of finance usually is quite popular in developing countries, as it often deals with customers below the poverty line.

The origin of microfinance can be traced back to Bangladesh in the 1970s when Nobel Peace Prize laureate Muhammad Yunus founded the Grameen Bank. The bank was established to provide small loans to the poor, particularly women, to help them start or expand their businesses. This innovative approach proved to be successful, and since then, microfinance has become a worldwide movement, reaching millions of people in developing countries.

One of the key advantages of microfinance is that it helps to reduce poverty by providing individuals with the necessary resources to start or expand their businesses. This, in turn, creates jobs, increases incomes, and improves overall economic growth. Microfinance also promotes financial inclusion by providing access to credit and other financial services to people who are often excluded from the formal financial sector, such as women in rural villages.

In addition to its positive impact on poverty reduction and financial inclusion, microfinance has also been shown to have a positive impact on women’s empowerment. NOCPL focuses solely on women, recognising their potential as entrepreneurs and recognising that they often face unique challenges in accessing financial services. By providing women with access to credit and other financial services, microfinance helps to empower them and promote gender equality.

Here at NOCPL, like many other microfinance institutions, our goal is to provide services to women from rural areas, providing them access to microloans to help them engage in productive activities or grow small businesses, to become then self-sustaining and break the cycle of poverty and bridge the disconnect between the urban and rural populations

Picture: NOCPL Relationship Officer onboarding a group of women for microloans

My work:

My office is on the 7th floor in a tall skyscraper called Cyber One, in Navi Mumbai. As the name probably suggests, most of the offices in the building are IT companies or finance firms, giving a much similar vibe to the PwC tower in Auckland. Quite fancy and corporate.

I will be here as an intern for six weeks. During my time here, I will be placed with every team, including teams based in the back-end, doing office work and in-field, doing practical work. I will record and learn how they operate, record their processes, suggest improvements, and provide comments. Essentially, provide an external perspective on what they are doing internally in NOCPL. In even simpler terms, as my supervisor has told me – internal management consulting.

Initially, I was shocked to take on such a big responsibility and task. I told my supervisor I am a uni student and not a qualified consultant at all, to which he replied that regardless, it would be a good experience for me to do some real-life consulting and for the company to get some outsider “Kiwi” insight into their microfinance operations.

So hopefully, those first-year case competitions and the critical thinking skills will pull through as I will be doing one for reals this time!

Workplace culture:

Everyone is super friendly and welcoming, and I am usually taught a new phrase in Hindi every day. Today’s phrase is ‘aap kaise hain?’ (how are you?).

At lunch, I get invited by different teams to go out and have lunch with them, which is an incredible experience, as often different teams have different go-to restaurants, so I get an awesome opportunity to taste a wide variety of food

I have even gotten numerous invites to people’s houses. Initially, I thought they were joking and just being friendly, but after being asked numerous times, I realised the true genuineness of Indian hospitality. I felt super honoured and privileged as they all said their families and kids would love to meet me and give me an Indian welcome to their homes.

Sometime this week, I will visit Payohdi, our Chief Technology Officer’s home, for an Indian party and stay over. This weekend, I also agreed to visit the hometown of my co-worker and friend, Rahul, from the finance team.

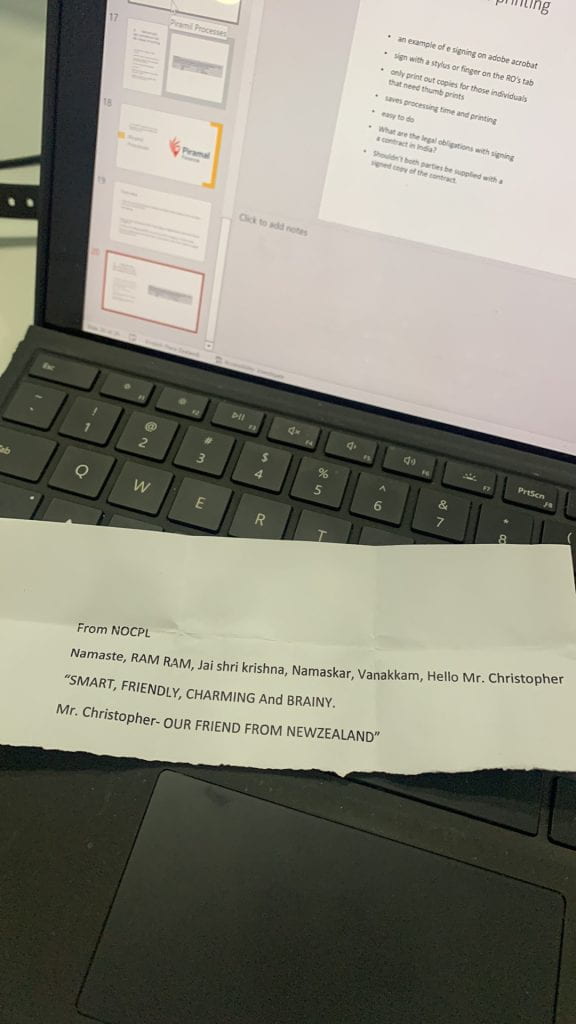

Here in the office, they often call me ‘Krish from New Zealand’. (Krish is the new Indian name I’ve been given, as many of my co-workers seem to have trouble pronouncing Chris, so they all started calling me Krish instead, haha.

Picture: A compliment I got from the work compliment box! 🤧

Being surrounded by a warm and welcoming community is truly a blessing. The fact that everyone is super friendly only adds to the richness of my experiences. Being able to immerse myself in different ways of life and communicating with people from diverse backgrounds helps me gain a deeper understanding and appreciation of the world.

Picture: Me with Sanjay and his family (he wants to study engineering in Auckland and come visit me in NZ once he finishes high school!)

Anyways, that’s all for this time’s blog…

In my next blog, I will outline my field visit trip to Pune, where I will get a chance to experience NOCPL operations on a field level. So everything would do here in the head office is back-end stuff, so most of the management and admin work. So I am also really grateful to go into the field and witness how relationship officers interact with clients and do their jobs first-hand.

I’m really excited as it’s not only a chance to step outside the office but also to experience yet another part of India

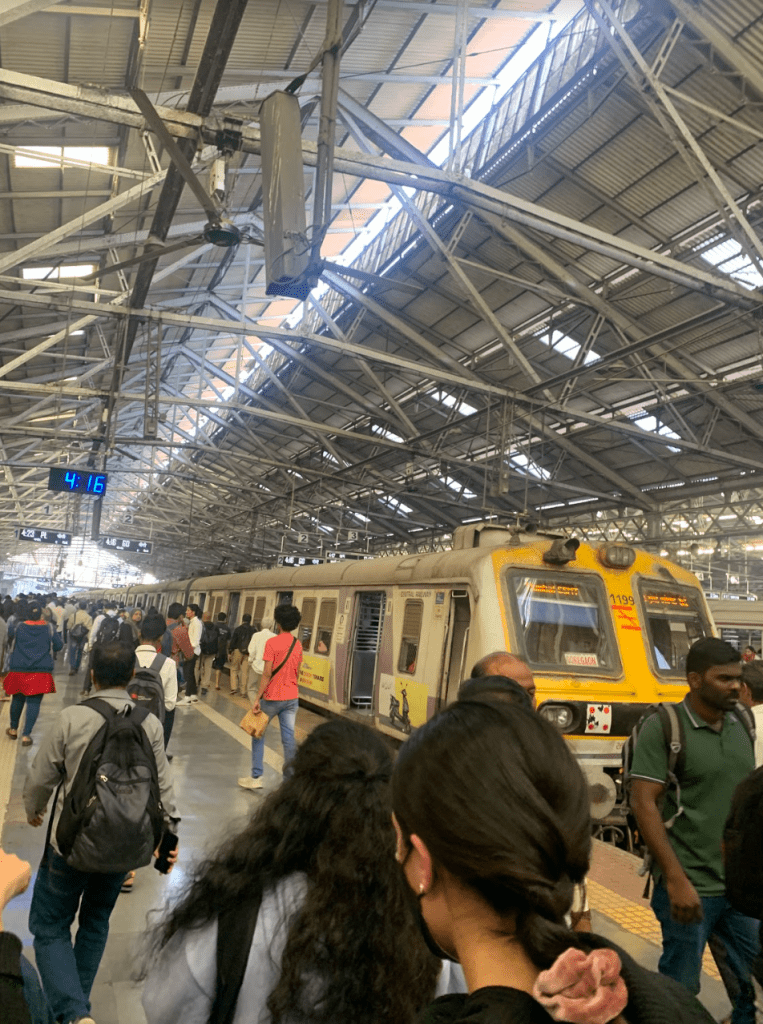

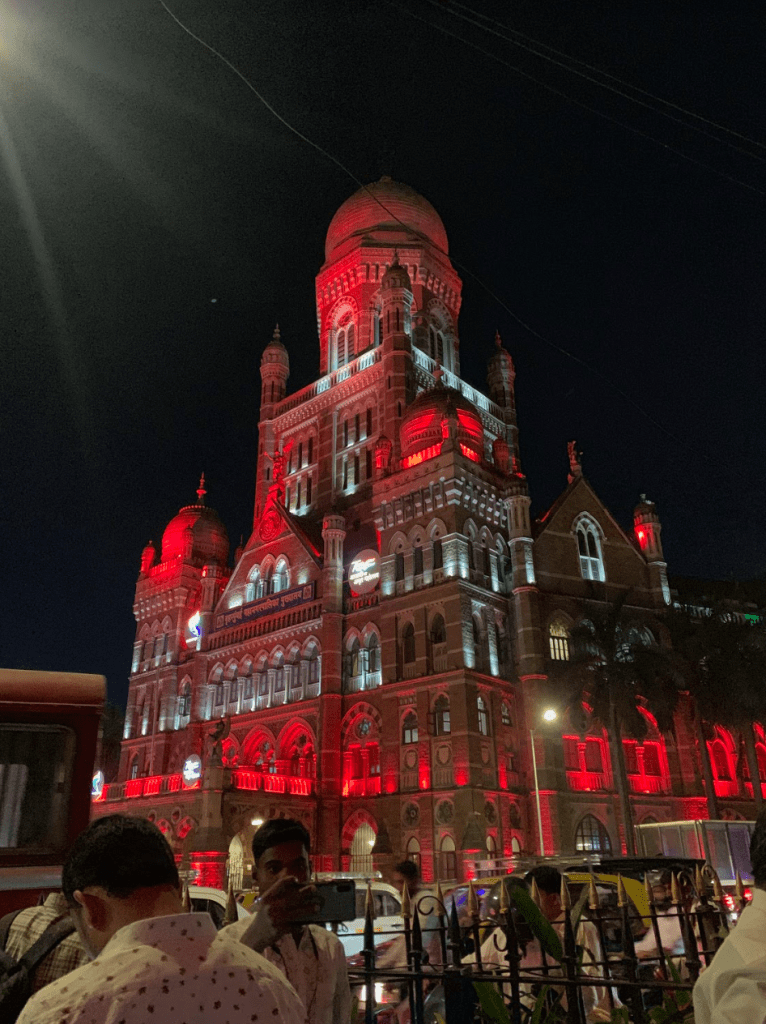

Pictures: 1. Chhatrapati Shivaji Maharaj Terminus (CST train station), the train I catch to work 2. CST Station outside at night

Alvida! (See ya!)

Picture: Jana and I fort trekking at Sondai Fort